In recent years, the world of cryptocurrencies has witnessed exponential growth, attracting investors from various backgrounds. One segment of the cryptomarket that has gained significant attention is "Crypto Gems," which refers to emerging cryptocurrencies with high growth potential.

While investing in Crypto Gems can offer exciting opportunities, it is essential to consider the ethical implications associated with such investments.

This article will discuss what are the ethical considerations of investing in crypto gems.

Understanding Crypto Gems

Crypto Gems are cryptocurrencies that are relatively new and have the potential for substantial growth.

When compared to more established cryptocurrencies like Bitcoin and Ethereum, these gems typically function on less extensive networks and have a lower total market capitalization.

The possibility of receiving large returns on one's investment in a very short amount of time makes the prospect of investing in Crypto Gems alluring.

Lack Of Regulation And Potential Risks

Investing in crypto gems brings up one of the most significant ethical problems because there is no regulatory supervision over the market.

The cryptocurrency market, on the other hand, operates in a decentralized manner, which means that it is not subject to the same level of regulation and scrutiny as traditional financial markets are. This is because the cryptocurrency market is not governed by a central authority.

There is a greater likelihood of cons, fraud, and market manipulation occurring because there is no legislation in place to prevent them.

What are the main risks of cryptocurrency? Analytics Insightsaid that Bitcoin's most significant shortcoming is the lack of clarity surrounding its long-term prospects.

When dealing with digital transactions, there is always the possibility of experiencing high volatility, as well as a number of other risks. It is for this reason, along with many others, that you should steer clear of investing in cryptocurrency in 2023.

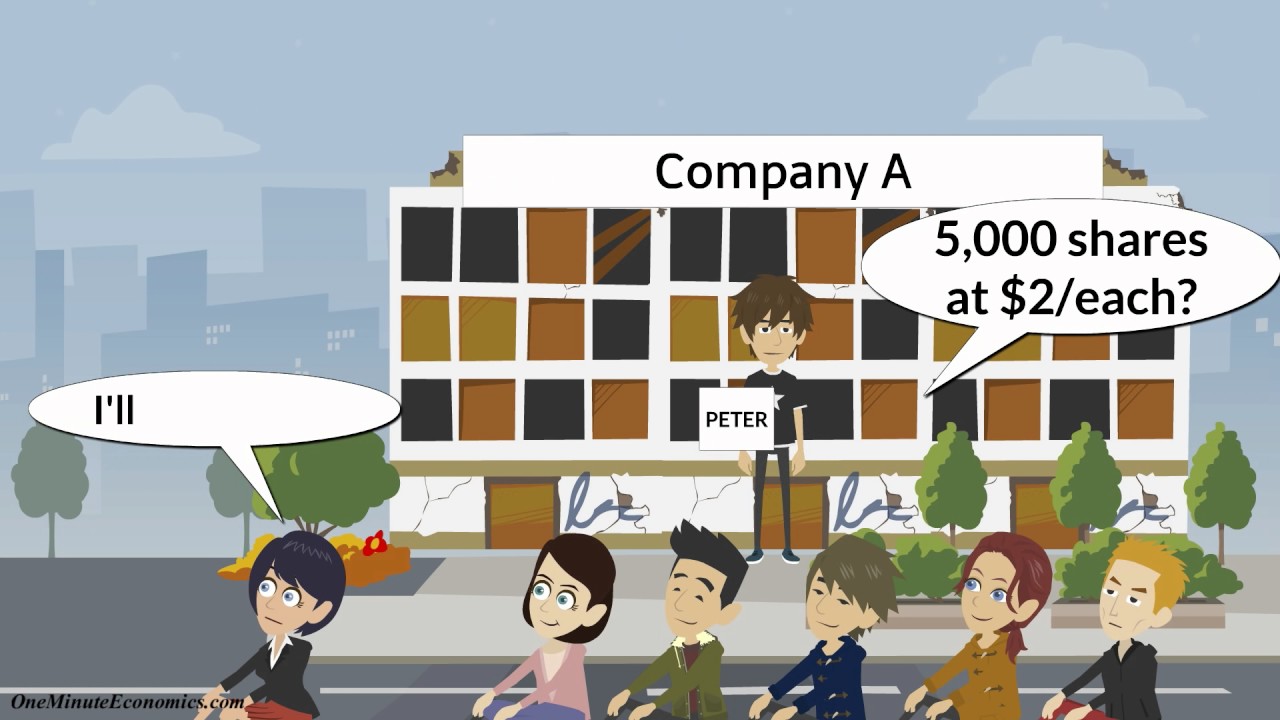

Pump And Dump Schemes

In the realm of Crypto Gems, pump and dump strategies is a frequent ethical concern that needs to be addressed.

By disseminating information that is intentionally incorrect or misleading, the individuals or groups participating in these schemes attempt to artificially drive up the price of a specific cryptocurrency.

Pump and Dump Schemes Explained in One Minute

Once the price reaches a certain level, the perpetrators sell their holdings, causing the price to plummet, leaving other investors with significant losses.

Insider Trading And Market Manipulation

Due to the unregulated nature of the crypto market, insider trading and market manipulation are other ethical concerns. Individuals with access to privileged information can exploit it for personal gain, harming other investors.

Market manipulation techniques, such as wash trading and spoofing, can distort the market and create a false sense of demand or supply.

Environmental Impact

Mining cryptocurrency, which is required for the operation of a great deal of Crypto Gems, has a sizeable effect on the surrounding environment.

According to Columbia University, this requires a significant quantity of energy, which is normally derived from the combustion of fossil fuels.

The mining of cryptocurrencies is responsible for the annual emission of 140 million metric tons of carbon dioxide into the atmosphere, which is comparable to 0.3% of all greenhouse gas emissions worldwide, according to research that was published by the White House.

Investing in Crypto Gems without taking into account the amount of energy they require to operate might contribute to the deterioration of the environment.

Wealth Disparity And Economic Inequality

There is a risk that investing in Crypto Gems would worsen existing wealth disparities and contribute to economic inequality. Those who are early adopters of technology and those who have large wealth stand to gain significantly from investing in new cryptocurrencies.

However, those with lower financial means might not have access to the same opportunities, which would result in an even greater disparity between the wealthy and the impoverished.

Supporting Illicit Activities

It is said that unlawful actions including as moneylaundering, evading taxes, and sponsoring illegal operations were carried out with the help of crypto gems. These allegations have been brought forward.

It is of the utmost importance that you, as an investor, take into mind the possibility that the virtual currency in which you are investing is linked, in some way, to illegal activities.

It is unethical to promote cryptocurrencies that have ties to illegal conduct, and the person who does so runs the risk of having legal implications brought against them as a result of their actions.

Social Responsibility And Sustainable Investments

When engaging in ethical investing, one must evaluate not just how their investments would influence the natural environment, but also how those investments would affect society. This is because ethical investing takes into consideration not only the natural environment but also society.

Investors who are interested in Crypto Gems should research the initiatives that are generating these cryptocurrencies in order to have an understanding of their principles, level of social responsibility, and commitment to sustainability. These digital assets are known as Crypto Gems in the industry.

Why investors are turning to sustainable and socially responsible investing

It is possible to contribute to positive change and long-term sustainable development by investing in projects that are in alignment with one's values.

Due Diligence And Research

It is essential to carry out an exhaustive study and perform all necessary due diligence before investing in any Crypto Gem.

This comprises looking at the project's whitepaper, gaining knowledge of the team that is behind it, analyzing its technology and prospective use cases, and determining how the market as a whole feels about it.

Also, KYC-Chainsaid that this procedure involves doing Know Your Customer (KYC) checks, but it also takes into account the entire behavior of clients and evaluates transactions to see whether or not they are unusual or suspicious and need to be reported to the relevant financial regulators.

Engaging in proper research minimizes the risk of falling victim to scams or investing in unethical projects.

Navigating The Psychological Pressures Of Investing In Crypto Gems

Putting your money into Crypto Gems, which are up-and-coming cryptocurrencies that have a high development potential, may be an undertaking that is both exhilarating and mentally taxing.

Investors frequently face novel psychological pressures due to the fast-paced nature of the cryptocurrency market and the temptation of huge returns. However, they are required to successfully traverse these challenges.

It is necessary to have a solid understanding of these forces and an effective management strategy in order to make informed and logical investment decisions.

The Excitement and Fear of Missing Out (FOMO)

- FOMO, or the fear of missing out, is a powerful psychological force that can drive investors to make impulsive decisions.

- The volatility of the crypto market, with rapid price fluctuations, intensifies the FOMO phenomenon.

- Investors may feel compelled to jump on the bandwagon, fearing that they will miss out on the next big opportunity, even if it means taking on unnecessary risks.

Emotional Roller Coaster of Market Volatility

- Market volatility in the crypto space can lead to emotional highs and lows.

- Sharp price swings can trigger excitement, euphoria, anxiety, and fear among investors.

- It is essential to remain level-headed and make rational decisions based on research and analysis rather than succumbing to emotional impulses.

Overcoming Confirmation Bias

- Confirmation bias is the tendency to seek information that confirms one's existing beliefs and ignore contradictory evidence.

- Investors may cherry-pick positive newsand opinions that align with their investment choices, leading to biased decision-making.

- It is crucial to maintain objectivity, consider diverse perspectives, and critically evaluate information before making investment decisions.

Dealing with Loss Aversion

- Loss aversion refers to the tendency to feel the pain of losses more strongly than the pleasure of gains.

- Crypto Gem investments can be highly volatile, and investors may experience significant losses.

- Overcoming loss aversion requires accepting that losses are a part of investing and maintaining a long-term perspective.

The Influence of Social Media and Peer Pressure

- Social media platforms play a significant role in shaping investment decisions and driving market sentiment.

- The positive or negative sentiment expressed by influential individuals or communities can sway investor behavior.

- It is important to conduct independent research and not solely rely on social media hype when making investment choices.

Managing Impulsive Trading Behavior

- The fast-paced nature of the crypto market can lead to impulsive trading decisions.

- Investors may be tempted to buy or sell based on short-term market trends or rumors.

- Establishing a well-defined investment strategy and sticking to it helps avoid impulsive actions driven by market noise.

Seeking Professional Guidance and Education

- Investing in Crypto Gems can be complex, especially for newcomers.

- Seeking guidance from reputable professionals, financial advisors, or experienced investors can provide valuable insights and help mitigate psychological pressures.

- Educating oneself about the fundamentals of cryptocurrencies and investment strategies is crucial for making informed decisions.

Practicing Patience and Discipline

- Patience and discipline are essential virtues for successful investing in Crypto Gems.

- It is important to resist the urge to chase quick gains and maintain a long-term perspective.

- Following a disciplined approach, conducting thorough research, and adhering to a well-thought-out investment plan can lead to better outcomes.

To successfully navigate the psychological demands that come with investing in Crypto Gems, one needs to have a high level of self-awareness, emotional intelligence, and mental discipline.

Investors have the ability to make more educated selections and effectively regulate their emotions if they have a solid awareness of the psychological biases and problems connected with this fast-paced market. Keep in mind that your investment in crypto gems should

People Also Ask

Is Investing In Crypto Gems Illegal?

Investing in Crypto Gems is not illegal in itself. However, it is essential to be aware of potential scams and fraudulent schemes associated with some Crypto Gems.

How Can I Identify A Potential Pump And Dump Scheme?

Be cautious of cryptocurrencies that experience sudden and drastic price increases accompanied by aggressive marketing tactics. Research the project, its fundamentals, and its community before making investment decisions.

What Steps Can I Take To Minimize The Environmental Impact Of Crypto Gem Investments?

Consider investing in cryptocurrencies that utilize eco-friendly mining practices or explore sustainable alternatives such as proof-of-stake (PoS) or proof-of-authority (PoA) consensus mechanisms.

Can Investing In Crypto Gems Contribute To Economic Inequality?

Investing in Crypto Gems has the potential to widen the wealth gap if certain individuals or groups have exclusive access to information or resources. It is essential to promote inclusivity and equal opportunities within the crypto space.

How Can I Ensure That My Investments Align With My Values And Social Responsibility?

Conduct thorough research on the project's mission, values, and commitment to sustainability. Look for transparency and social impact initiatives that align with your ethical standards before making investment decisions.

Conclusion

Investing in Crypto Gems can be a lucrative endeavor, but it is crucial to consider the ethical implications. The lack of regulation, potential scams, market manipulation, environmental impact, wealth disparity, and association with illicit activities are all ethical concerns worth examining.

By conducting due diligence, investing responsibly, and supporting projects with a focus on sustainability, investors can navigate the world of Crypto Gems ethically and responsibly.