Cryptocurrencies have revolutionized the investment landscape, offering lucrative opportunities for investors to generate substantial returns.

While popular cryptocurrencies like Bitcoin and Ethereum dominate the market, there are also hidden gems that can potentially provide even higher profits.

In this article, we will explore profitable cryptogem investment strategiesthat can help you maximize your gains in the volatile world of cryptocurrencies.

Understanding Crypto Gems

Crypto gemsare relatively new and undiscovered cryptocurrencies that have the potential for significant growth. These gems often have low market capitalization and are not yet on the radar of most investors.

Investing in crypto gems requires careful analysis and research, but it can yield substantial returns if done correctly.

The Importance Of Strategies In Investing In Crypto Gems

Investing in cryptocurrencies has gained tremendous popularity over the years, with the emergence of numerous digital assets. Among these assets, crypto gems, or low-cap cryptocurrencies with significant growth potential, have attracted the attention of many investors.

However, navigating the volatile and complex crypto market requires careful planning and strategies.

- Crypto gems refer to low-cap cryptocurrencies that have the potential for significant price appreciation.

- These gems are often overlooked or undervalued by mainstream investors.

- Their market capitalization is relatively small compared to well-known cryptocurrencies like Bitcoin and Ethereum.

- Crypto gems are characterized by high volatility and the possibility of rapid price swings.

- Identifying promising crypto gems requires in-depth research, analysis, and an understanding of market trends.

Reasons For Implementing Investment Strategies

Risk Management:

- The crypto market is highly volatile and can experience extreme price fluctuations within short periods.

- Strategies help mitigate risks by diversifying your investments across different crypto gems, asset classes, and risk levels.

- Setting stop-loss orders and profit targets can protect your capital and lock in gains.

- Implementing risk management strategies allows investors to stay focused on their long-term goals.

Research and Analysis:

- Strategies help investors conduct thorough research on potential crypto gems.

- They enable the analysis of fundamental factors, such as the project's team, technology, market demand, and tokenomics.

- Technical analysis strategies can identify price patterns, support, and resistance levels, and optimal entry and exit points.

- A well-planned strategy ensures that investors make informed decisions based on data and analysis.

Timing and Market Entry:

- Developing a strategy helps determine the right time to enter the market and invest in crypto gems.

- Timing is crucial in the highly volatile crypto space, as it can significantly impact returns.

- Strategies can involve dollar-cost averaging, where investments are spread out over time, reducing the risk of buying at a market peak.

- Identifying market cycles and using timing indicators can increase the chances of profitable investments.

Emotional Discipline:

- The crypto market is notorious for triggering emotional responses, such as fear and greed, which can lead to irrational decision-making.

- Strategies promote emotional discipline by setting predefined rules and guidelines for buying, selling, and managing investments.

- Following a well-defined strategy helps investors avoid impulsive actions driven by short-term market fluctuations.

Types Of Strategies For Crypto Gem Investments

Fundamental Analysis:

- Involves evaluating the underlying value and potential of a crypto gem based on factors like technology, team, partnerships, and adoption.

- Considers the long-term viability and growth prospects of the project.

Technical Analysis:

- Uses historical price and volume data to identify patterns and trends in the market.

- Involves the use of indicators, chart patterns, and statistical models to predict future price movements.

Portfolio Diversification:

- Spreading investments across multiple crypto gems reduces the risk of concentration in a single asset.

- Can include a mix of low-cap, mid-cap, and high-cap cryptocurrencies to balance potential returns and risks.

Research And Due Diligence

Before investing in any crypto gem, it is crucial to conduct thorough research and due diligence. Examine the project's whitepaper, team members, partnerships, and the problem it aims to solve.

According to KYC-Chain, this procedure involves doing Know Your Customer (KYC) checks, but it also takes into account the entire behavior of clients and evaluates transactions to see whether or not they are unusual or suspicious and need to be reported to the relevant financial regulators.

Assess the market demand for the cryptocurrency and its potential for adoption. Additionally, consider the project's roadmap and future plans. Investing in crypto gems with solid fundamentals increases the likelihood of profitable returns.

Diversification

The notion of diversification is an essential component of any successful investment strategy, and the same is true for crypto jewels. Spread your investment among a number of different initiatives that look potential rather than putting all of your moneyinto just one.

Investing in multiple crypto gems spreads out the risk that would otherwise be concentrated in a single asset. You can reduce the likelihood of incurring losses while also increasing your odds of capitalizing on the next big winner if you diversify your holdings.

Long-Term Holding

Crypto gems almost always call for an investment strategy with a longer time horizon. It could take some initiatives a short amount of time to reach their full potential, while others could enjoy exponential growth.

Your assets will be able to mature and you will be able to benefit from the overall expansion of the cryptocurrency market if you adopt a strategy of holding for a lengthy period of time.

Identifying Potential Gems

Identifying potential crypto gems requires a keen eye for innovation and market trends. Look for projects that offer unique solutions, have a disruptive technology, or target underserved markets.

Projects that have a strong community and active development team also indicate promising investment opportunities.

Assessing Market Sentiment

Understanding market sentiment is crucial in the crypto world. Analyze social media platforms, online communities, and newsoutlets to gauge the overall sentiment toward a particular crypto gem.

Positive sentiment can attract more investors and drive up the price, while negative sentiment may indicate potential risks or issues surrounding the project.

Taking Advantage Of Early Entry Points

Investing in crypto gems at early entry points can yield significant profits. Keep an eye on initial coin offerings (ICOs) or token sales, where you can acquire tokens at a lower price before they hit exchanges.

Participating in pre-sales or private sales can provide you with an opportunity to secure tokens at discounted rates, increasing your potential returns.

Monitoring And Adjusting Your Portfolio

Successful crypto gem investment requires active monitoring of your portfolio. Stay updated with the latest news, project developments, and market trends.

Monitoring Your Portfolio and Making Adjustments

Regularly reassess your investments and make adjustments based on new information. Be prepared to reallocate your funds if necessary to maximize your gains.

How do you monitor a portfolio? Here are the tips from groww.in:

- Keep Yourself Updated About the Latest News About the Company

- Analyze the Quarterly Results of the Company

- Keep Tabs on Any Corporate Announcements

- Be Aware of Any Changes in the Shareholding Pattern

- Check the Credit Rating of The Company

- Track the Stock Price.

Risk Management

Crypto investments inherently carry risks, and investing in crypto gems is no exception. It is crucial to set clear risk management strategies to protect your investment capital.

Establish stop-loss orders to limit potential losses and consider taking profits along the way to secure your gains. By managing risks effectively, you can minimize the impact of market downturns and protect your investment portfolio.

Staying Informed And Updated

The crypto market is highly dynamic, and staying informed is vital for successful investments. Follow reputable cryptocurrency news sources, join relevant communities, and engage in discussions with experienced investors.

Continuously educating yourself about the industry and emerging trends will help you make informed investment decisions.

Common Mistakes To Avoid

- Falling for hype without conducting proper research.

- Neglecting risk management and investing more than you can afford to lose.

- Failing to diversify your portfolio and relying on a single crypto gem.

- Ignoring the importance of market sentiment and community engagement.

- Letting emotions drive your investment decisions instead of relying on research and analysis.

Potential Scams In Investing In Crypto Gems

Investing in crypto gems, the low-cap cryptocurrencies with growth potential can be a lucrative venture. However, it's crucial to be aware of the potential scams and fraudulent activities prevalent in the crypto space.

The Risks of Investing in Cryptocurrency I Fortune

- Crypto gems often operate in a less regulated environment compared to established cryptocurrencies.

- Lack of transparency and limited information about these projects can make it difficult to evaluate their legitimacy.

- Scammers take advantage of investors' FOMO (Fear of Missing Out) by creating hype and false narratives around certain crypto gems.

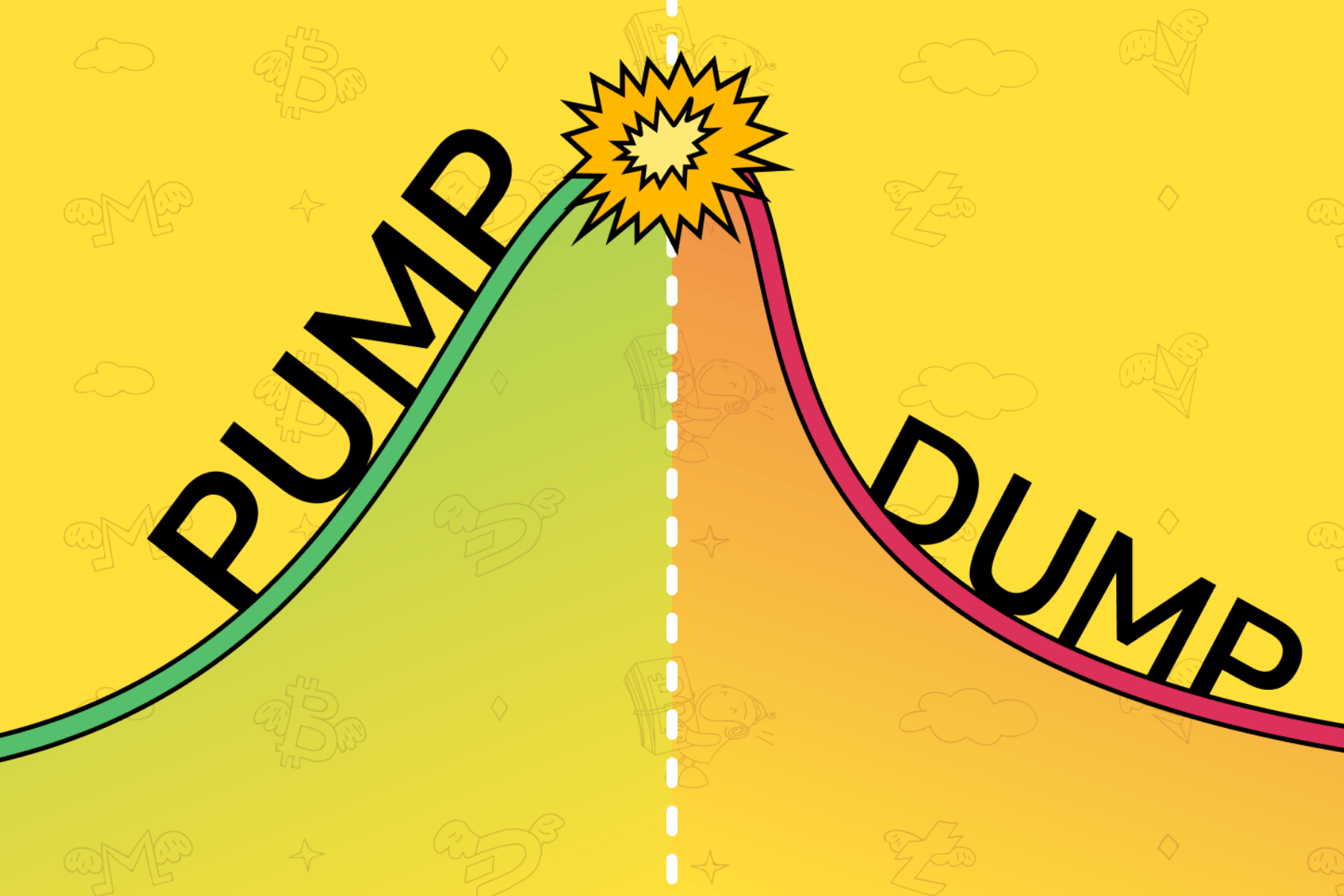

- Pump-and-dump schemes, where scammers artificially inflate the price of a crypto gem before selling their holdings, are common.

- Fake projects and exit scams, where the developers disappear after raising funds, can result in significant financial losses for investors.

Also, Money Smartexposed that investing in a fraudulent cryptocurrency exchange, website, or mobile application is one of the most common forms of cryptocurrency fraud. fraudulent cryptocurrency tokens, investments, or jobs in the cryptocurrency trading market. using cryptocurrencies to pay off con artists.

Red Flags And Warning Signs

Lack of Information:

- Scam projects often have limited or inconsistent information available about their team, technology, and roadmap.

- Poorly written whitepapers or plagiarized content are warning signs of potential scams.

- Fake social media profiles and websites can be created to deceive investors.

Unrealistic Promises:

- Scammers may promise unrealistic returns or guarantee profits, creating a sense of urgency to invest.

- Be cautious of projects that overstate their potential or use exaggerated marketing tactics.

Pump-and-Dump Activities:

- Sudden and dramatic price increases followed by rapid declines may indicate a pump-and-dump scheme.

- Vigilance is necessary when investing in crypto gems experiencing suspicious price movements.

Lack of Community Trust:

- Research the community sentiment and online discussions surrounding a crypto gem.

- Negative feedback, accusations of fraud, or a lack of genuine engagement from the project team can be red flags.

People Also Ask

What Are Crypto Gems?

Crypto gems are relatively unknown cryptocurrencies that have the potential for significant growth and profitability.

How Do I Identify Potential Crypto Gems?

Identify potential crypto gems by analyzing their whitepapers, team members, market demand, and future plans. Look for unique solutions and strong communities.

How Important Is Market Sentiment In Crypto Gem Investments?

Market sentiment plays a crucial role in crypto gem investments. Positive sentiment can drive up prices, while negative sentiment may indicate potential risks.

Should I Adopt A Long-term Holding Strategy For Crypto Gems?

Yes, a long-term holding strategy is often recommended for crypto gems as some projects take time to realize their full potential.

What Are Some Common Mistakes To Avoid When Investing In Crypto Gems?

Avoid falling for hype without proper research, neglecting risk management, failing to diversify, ignoring market sentiment, and making emotional investment decisions.

Conclusion

Investing in crypto gems can be highly profitable, but it requires careful planning, research, and risk management. By following the strategies outlined in this article, you can increase your chances of identifying promising crypto gems and maximizing your investment returns.

Remember to stay informed, diversify your portfolio, and adopt a long-term investment approach. With diligent effort and a disciplined approach, you can navigate the world of crypto gems and unlock substantial profits.