Crypto gems, also known as low-cap cryptocurrencies with high growth potential, have gained significant attention in the financial world.

These gems have become popular investment opportunities for those seeking high returns, despite the high volatility associated with the cryptocurrency market. But, how do crypto gems fit into a diversified investment portfolio?

In this article, we will explore the steps to include cryptogems in a diversified portfolio and the potential benefits and risks associated with this investment strategy.

Step-by-Step Guide To Including Crypto Gems In A Diversified Investment Portfolio

Crypto Portfolio Diversification Tips For Beginners!

- Understand the risks- Before investing in any cryptocurrency, it's important to understand the risks associated with the investment. Crypto gems are highly volatile, and the market can be affected by a wide range of factors, including regulatory changes, technological advancements, and overall market sentiment. Therefore, investors should be prepared to handle high fluctuations in the value of their investments.

- Research potential crypto gems- Once you have a good understanding of the risks, it's time to research potential crypto gems that you might want to include in your portfolio. Conduct a thorough analysis of the market and identify the most promising cryptocurrencies that fit your investment goals and risk appetite.

- Determine your investment strategy- Decide on your investment strategy and the amount you are willing to invest in crypto gems. You should consider factors such as your investment goals, the amount of risk you are willing to take, and your portfolio diversification strategy.

- Select a reputable exchange- Choose a reputable exchange that supports the crypto gems you want to invest in. Research the exchange's security measures, reputation, and fees before making any transactions.

- Purchase and store your crypto gems- Once you have chosen the crypto gems you want to invest in and the exchange you want to use, it's time to make your purchase. After buying the cryptocurrencies, it's essential to store them safely in a secure wallet. Choose a wallet that offers high-security features, such as two-factor authentication and cold storage.

- Monitor your investments- Keep track of your investments regularly to understand the performance of your portfolio. You should regularly analyze your portfolio to ensure that it aligns with your investment goals and make any necessary adjustments to your strategy.

Benefits Of Including Crypto Gems In A Diversified Investment Portfolio

Including crypto gems in a diversified investment portfolio can offer several benefits, such as:

- High potential returns- Crypto gems have the potential to generate high returns, even though they come with high risks.

- Portfolio diversification- Crypto gems can help diversify a traditional investment portfolio and provide exposure to a new asset class.

- Inflation hedge- Cryptocurrencies are seen by some as an inflation hedge as they are decentralized and not influenced by government monetary policies.

- Blockchain technology- Investing in crypto gems can provide exposure to blockchain technology, which has been touted as the future of finance and has the potential to revolutionize various industries.

Risks Of Including Crypto Gems In A Diversified Investment Portfolio

However, there are also some risks associated with including crypto gems in a diversified investment portfolio. These risks include:

- High volatility- Crypto gems are highly volatile and can experience significant price fluctuations, making them a risky investment.

- Lack of regulation- The cryptocurrency market is largely unregulated, making it susceptible to fraud and market manipulation.

- Cybersecurity risks- Cryptocurrency exchanges and wallets can be vulnerable to cyber-attacks, which can lead to the loss of investors' funds.

- Liquidity issues- Crypto gems may suffer from low liquidity, making it difficult to buy or sell them at market prices.

Crypto Gems Vs. Blue-Chip Cryptocurrencies - Which Is Right For Your Portfolio?

When it comes to investing in cryptocurrencies, many investors often face a dilemma: Should they invest in well-known, blue-chip cryptocurrencies such as Bitcoin and Ethereum, or take a chance on smaller, lesser-known cryptocurrencies, commonly known as "crypto gems"?

CryptoCorner: What Are The Top Blue Chip Crypto Coins?

Crypto gems refer to cryptocurrencies with smaller market capitalizations and lower trading volumes. These coins often have the potential for high returns but come with higher risks due to their volatility and susceptibility to market manipulation.

On the other hand, blue-chip cryptocurrencies such as Bitcoin and Ethereum are well-established and have a more significant market capitalization, making them less volatile and more stable.

However, their high value may limit their growth potential compared to smaller, emerging cryptocurrencies.

So, which is right for your investment portfolio: crypto gems or blue-chip cryptocurrencies?

Factors To Consider

The decision of whether to invest in crypto gems or blue-chip cryptocurrencies ultimately depends on individual investor preferences, risk tolerance, and investment goals. Here are some factors to consider when making this decision:

Risk Vs. Reward

Crypto gems may offer higher growth potential but also come with higher risks. They may experience significant price fluctuations due to their smaller market capitalization and low trading volume, making them more susceptible to market manipulation.

Blue-chip cryptocurrencies, on the other hand, are more established and have a more significant market capitalization, making them less volatile.

Liquidity

Liquidity is an essential factor to consider when investing in cryptocurrencies. Blue-chip cryptocurrencies such as Bitcoin and Ethereum are more liquid than crypto gems, meaning they are easier to buy and sell quickly.

Crypto gems may have lower liquidity, meaning it may be more challenging to buy or sell them, particularly during periods of high volatility.

Diversification

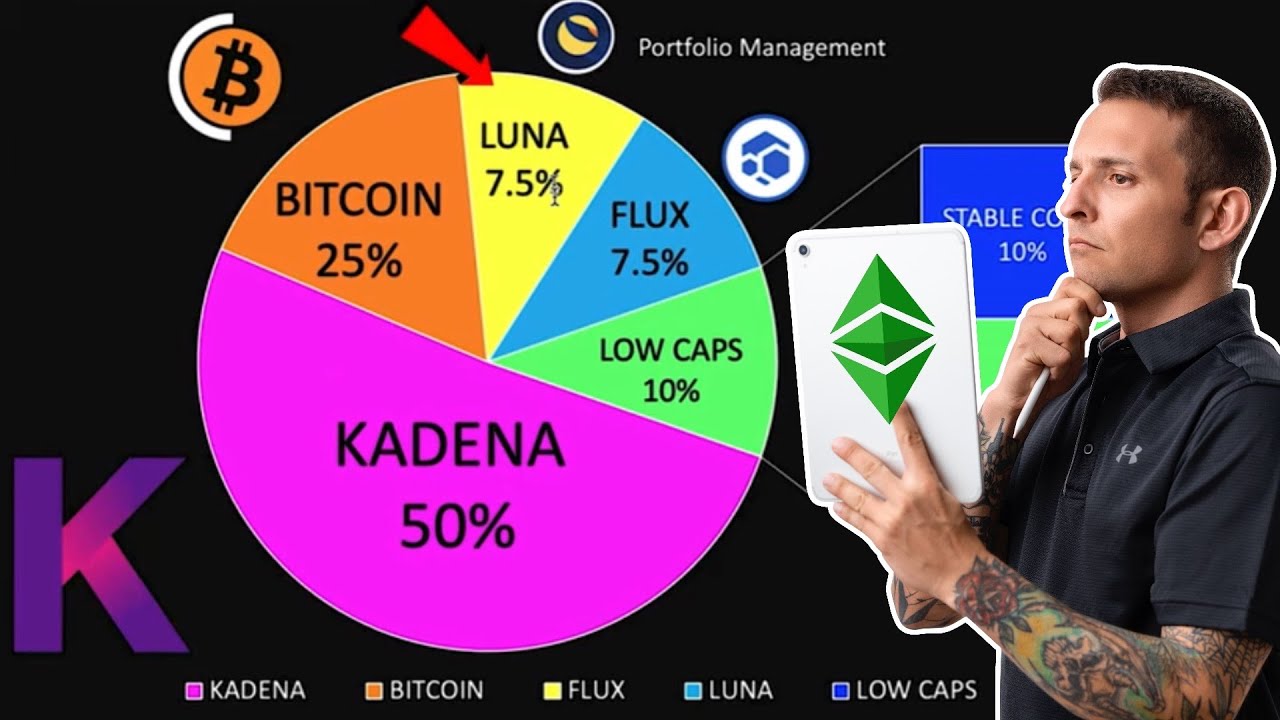

Diversification is crucial when investing in cryptocurrencies. Investing in a mix of blue-chip cryptocurrencies and crypto gems can provide a balanced portfolio with the potential for high returns and reduced risks.

Diversifying across different types of cryptocurrencies can provide exposure to a wide range of investments and help to spread risks.

Which Is Right For Your Portfolio?

Deciding whether to invest in blue-chip cryptocurrencies or crypto gems depends on your investment goals, risk tolerance, and diversification strategy. Here are some scenarios where each type of cryptocurrency may be more appropriate:

Investing In Blue-Chip Cryptocurrencies:

- If you're a conservative investor looking for a more stable, less volatile investment option, blue-chip cryptocurrencies may be a better fit.

- If you're looking to invest in a more liquid asset, blue-chip cryptocurrencies may be a better choice.

- If you're looking to invest in a cryptocurrency with a more established market dominance and wider adoption, blue-chip cryptocurrencies are a safer bet.

Investing In Crypto Gems:

- If you're willing to take on higher risks in exchange for higher potential returns, crypto gems may be a good fit.

- If you're looking to diversify your investment portfolio with emerging technologies, investing in crypto gems may provide exposure to new and exciting projects.

- If you're looking for a long-term investment strategy that can withstand market volatility, investing in crypto gems may pay off in the long run.

People Also Ask

What Are Crypto Gems?

Crypto gems are low-cap cryptocurrencies with high growth potential. These are often undervalued or undiscovered coins that have the potential to increase in value significantly over time.

How Do Crypto Gems Differ From Other Cryptocurrencies?

Crypto gems differ from other cryptocurrencies in terms of their market capitalization. They are often considered low-cap or small-cap coins, meaning they have a lower market capitalization compared to the more well-known cryptocurrencies such as Bitcoin and Ethereum.

How Can Investors Mitigate The Risks Associated With Investing In Crypto Gems?

Investors can mitigate the risks associated with investing in crypto gems by conducting thorough research on potential coins, diversifying their portfolio, and investing only what they can afford to lose. They should also store their investments securely in a reputable wallet and regularly monitor their portfolio to make necessary adjustments.

What Role Do Crypto Gems Play In A Diversified Investment Portfolio?

Crypto gems can provide diversification to a traditional investment portfolio, offering exposure to a new asset class with high potential returns. However, investors should be aware of the risks associated with these investments and carefully consider their investment goals and risk tolerance before adding them to their portfolios.

Conclusion

Crypto gems can be a viable option for investors seeking high returns and portfolio diversification. However, these investments come with high risks, and investors must understand the potential benefits and drawbacks of including crypto gems in their investment portfolios.

By following the step-by-step guide outlined in this article and conducting thorough research, investors can make informed decisions about adding crypto gems to their portfolios.

It's essential to monitor investments regularly and make necessary adjustments to ensure that the portfolio aligns with investment goals and risk tolerance.