Are you wondering how can I invest in crypto gems? Cryptocurrency is a digital asset that has gained widespread attention in recent years.

With the advent of blockchain technology, the decentralized nature of cryptocurrencies has made them popular with investors looking for an alternative to traditional assets.

Among the various cryptocurrencies available, Crypto Gemsis one that has caught the attention of many investors. In this article, we will explore what CryptoGems is and how you can invest in it.

What Are Crypto Gems?

The term "Crypto Gems" is used to describe cryptocurrencies that are not well known but have the potential to provide substantial returns on investment.

The majority of investors in traditional markets don't pay much attention to these cryptocurrencies, but those who are ready to take some financial risk can make significant gains with them.

Crypto Gems, also known as altcoins or alternative coins, are typically developed with the intention of addressing some of the shortcomings of Bitcoin, the cryptocurrency that was first introduced and remains the most widely used.

How To Invest In Crypto Gems

Investing in Crypto Gems can be a bit challenging for beginners, but with the right knowledge and tools, anyone can do it. Here are some steps to follow if you want to invest in Crypto Gems:

1. Research

Research is an absolute necessity before making any kind of investment in the bitcoin market.

Investigate the Crypto Gem you are interested in purchasing in order to get information about it, such as its market capitalization, pricing history, and potential for growth.

You should conduct research on the team that is behind the cryptocurrency to ensure that they have a solid track record and a positive reputation in the industry.

2. Choose A Crypto Exchange

Once you've done your research, you need to choose a cryptocurrency exchange where you can buy and sell Crypto Gems. There are several exchanges available, including Binance, Coinbase, and Kraken.

It's important to choose an exchange that is reputable and has a good track record of security.

3. Create An Account

After choosing an exchange, you need to create an account. This process usually involves providing your personal information and verifying your identity. You may also need to link a bank account or credit card to your account.

4. Fund Your Account

To invest in Crypto Gems, you need to fund your exchange account. This can be done by depositing fiat currency or other cryptocurrencies. Once your account is funded, you can start buying and selling Crypto Gems.

5. Buy Crypto Gems

After funding your account, you can start buying Crypto Gems. To do this, you need to search for the Crypto Gem you want to invest in and place an order.

You can buy Crypto Gems using fiat currency or other cryptocurrencies, depending on what the exchange supports.

6. Store Your Crypto Gems

After buying Crypto Gems, you need to store them in a secure wallet. There are several types of wallets available, including hardware wallets, software wallets, and paper wallets.

It's important to choose a wallet that is secure and has a good reputation.

Monitoring And Managing Your Crypto Gems Investments

Monitoring and managing your investments in Crypto Gems is crucial to ensuring that you make informed decisions and minimize risks.

In this part, we will discuss some tips and strategies for monitoring and managing your investments in Crypto Gems.

Stay Informed

The value of cryptocurrencies is extremely susceptible to sudden shifts because of the market's high degree of volatility. You need to keep up with the latest market news, trends, and advancements if you want to maintain your competitive advantage.

This can be accomplished in a number of ways, one of which is to follow important channels on relevant social media platforms, forums, and news publications that cover the cryptocurrency business.

You may also share your thoughts and strategies with other Crypto Gems investors by becoming a member of an online community of Crypto Gems investors.

Keep An Eye On Market Trends

Market trends can be a good indicator of the direction of a particular Crypto Gem's price. By keeping an eye on market trends, you can make informed decisions about whether to hold, buy or sell your Crypto Gems.

You can use various tools and resources to monitor market trends, such as technical analysis charts, price alerts, and trading signals.

Set Investment Goals

Before investing in Crypto Gems, it's essential to set clear investment goals. This will help you stay focused and avoid making impulsive decisions based on market fluctuations.

Your investment goals should be specific, measurable, attainable, relevant, and time-bound (SMART). For example, you may set a goal to achieve a certain percentage of returns within a specific period.

Diversify Your Portfolio

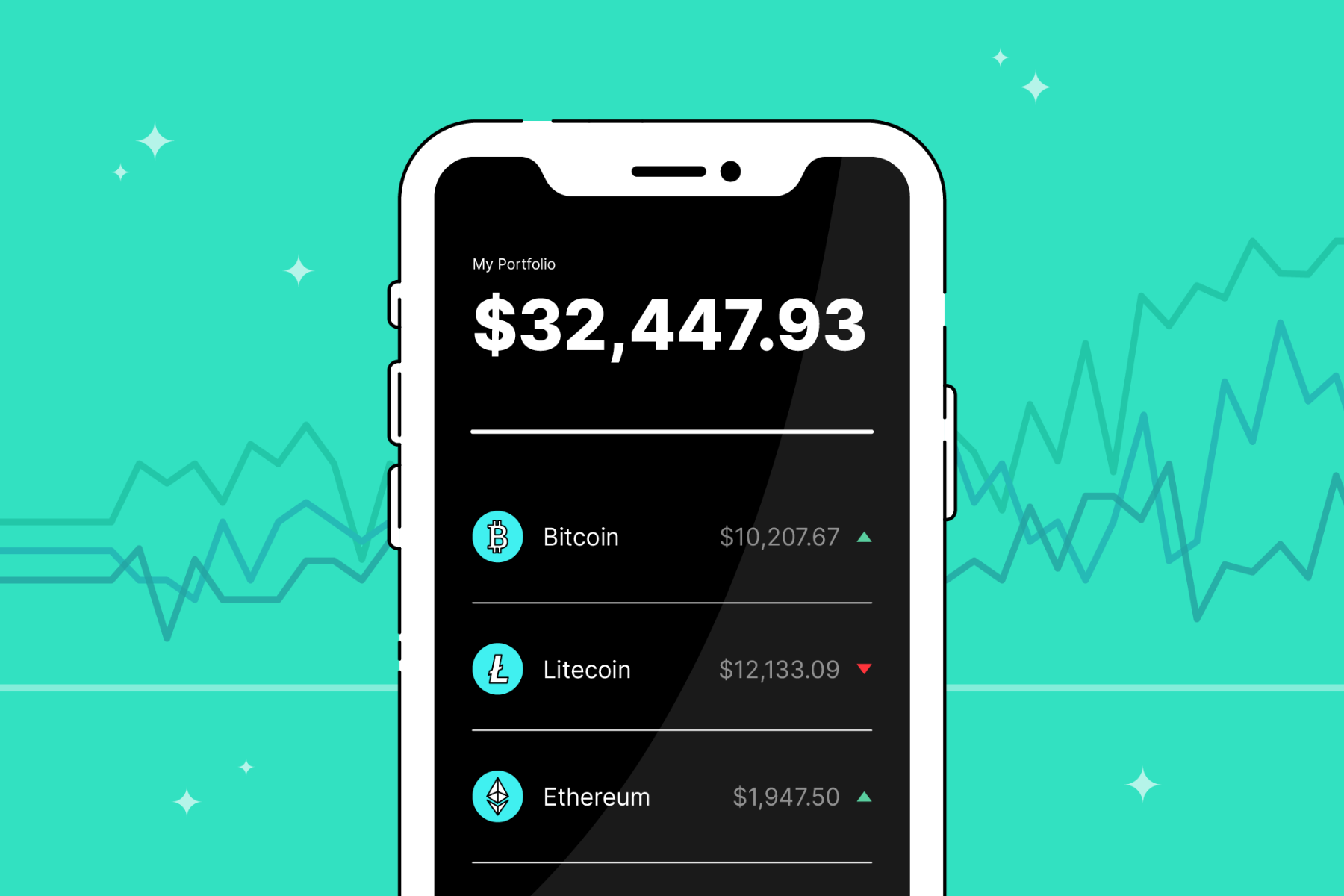

Diversification is a key strategy in minimizing risks and maximizing returns in any investment portfolio, including Crypto Gems.

10 Tips To Manage Your Crypto Portfolio Like a Boss!

By diversifying your portfolio, you spread your investment across different Crypto Gems, reducing the impact of any one asset's price fluctuations.

You can also diversify by investing in other asset classes, such as stocks, bonds, or real estate.

Set Stop-Loss Limits

Stop-loss orders are a useful tool for managing risks in any investment portfolio, including Crypto Gems. A stop-loss order is an instruction to sell a particular asset automatically if its price falls below a certain level.

By setting stop-loss limits, you can limit your losses and protect your investments from significant price drops.

Use Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of moneyat regular intervals, regardless of the asset's price.

This strategy can help you avoid making impulsive decisions based on market fluctuations and take advantage of market dips. For example, you may invest $100 every week in a particular Crypto Gem, regardless of its current price.

Rebalance Your Portfolio

Rebalancing your investment portfolio involves adjusting your asset allocation to maintain your desired risk and return levels.

By rebalancing your portfolio regularly, you can ensure that you're not overexposed to any particular asset and maintain a well-diversified portfolio.

You can rebalance your portfolio by selling some assets that have been appreciated and investing the proceeds in assets that have underperformed.

Seek Professional Advice

Investing in Crypto Gems can be challenging and risky, especially for beginners. If you're unsure about how to invest in Crypto Gems or need help managing your investments, it's a good idea to seek professional advice from a financial advisor who specializes in cryptocurrencies.

A financial advisor can help you develop a customized investment strategy that aligns with your goals, risk tolerance, and financial situation.

People Also Ask

How Do I Find Crypto Gems To Invest In?

To find Crypto Gems to invest in, you can research and analyze the market trends and price movements of different cryptocurrencies. You can also join online communities and forums dedicated to discussing crypto investments and sharing ideas with other investors.

What Are The Risks Of Investing In Crypto Gems?

The risks of investing in Crypto Gems include high volatility, lack of regulation, hacking, cyber-attacks, and scams and frauds. It's essential to do your research and invest only what you can afford to lose.

How Do I Store My Crypto Gems Safely?

To store your Crypto Gems safely, you need to use a secure wallet that provides strong encryption, two-factor authentication, and offline storage. You can choose from various types of wallets, such as hardware wallets, software wallets, and paper wallets.

How Do I Sell My Crypto Gems For Profit?

To sell your Crypto Gems for profit, you need to monitor market trends and price movements and identify the right time to sell. You can use various tools and resources, such as technical analysis charts, price alerts, and trading signals, to make informed decisions about when to sell. You can also use a crypto exchange platform to sell your Crypto Gems for fiat currency or other cryptocurrencies.

Conclusion

Investing in Crypto Gems can be a great way to diversify your portfolio and potentially earn high returns on investment. However, it's essential to do your research and understand the risks involved before investing.

By following the steps outlined in this article, you can invest in Crypto Gems and potentially reap the benefits of this exciting new asset class. Remember to always invest responsibly and only invest what you can afford to lose.